The financial industry has been significantly impacted by digital trends and FinTech businesses are part of that progression and modernization of the industry. Traditional banking and finance companies have found modernization more challenging as a result of cumbersome, legacy systems, the need to manage changes to regulations/laws within those existing systems and respond to global forces which continuously affect the industry.

FinTech start-ups and big tech companies have been able to capitalise on this and fill a gap in the market for more customer-centric banking and finance. Their streamlined approach has also enabled a cost-effective and personalized service for consumers. FinTech’s growth in market share has led to traditional banks needing to respond more rapidly to consumer demands and market challenges.

FinTech start-ups have a technological advantage over the larger, legacy banks as they can implement flexible, agile tech platforms from launch which make scaling easier. Big banks face the need to modernize and also continue to adhere to continuously evolving industry standards.

Banks and other financial institutions are increasingly aware of the importance of the customer experience and how technology can improve this. A business’ technology stack is important to be able to make changes to improve business efficiency, be competitive and respond to cyber threats quickly.

Banks need to be able to analyze large amounts of data in real-time to provide efficient and personalized interactions with customers, grow their customer bases and ensure security of customer assets.

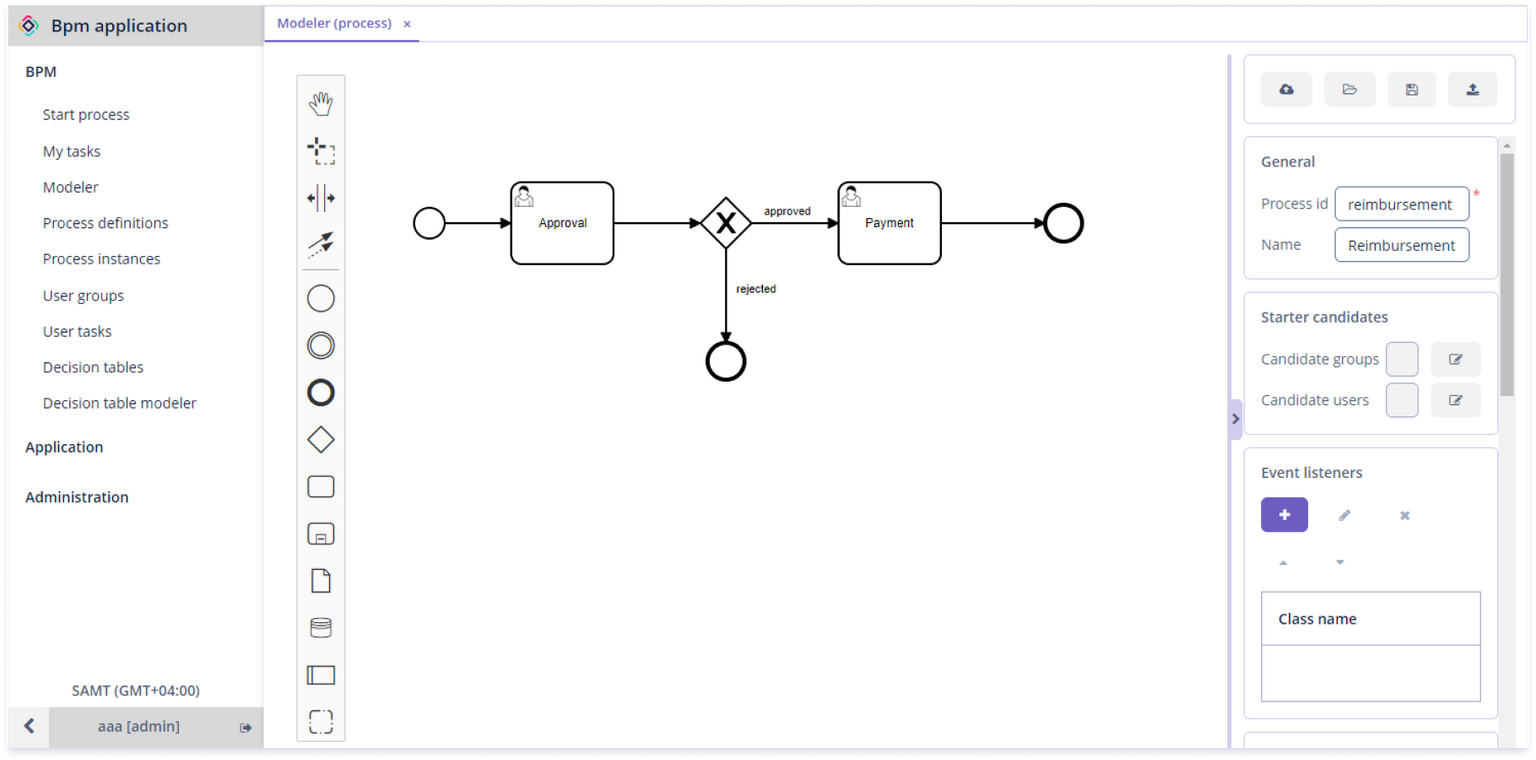

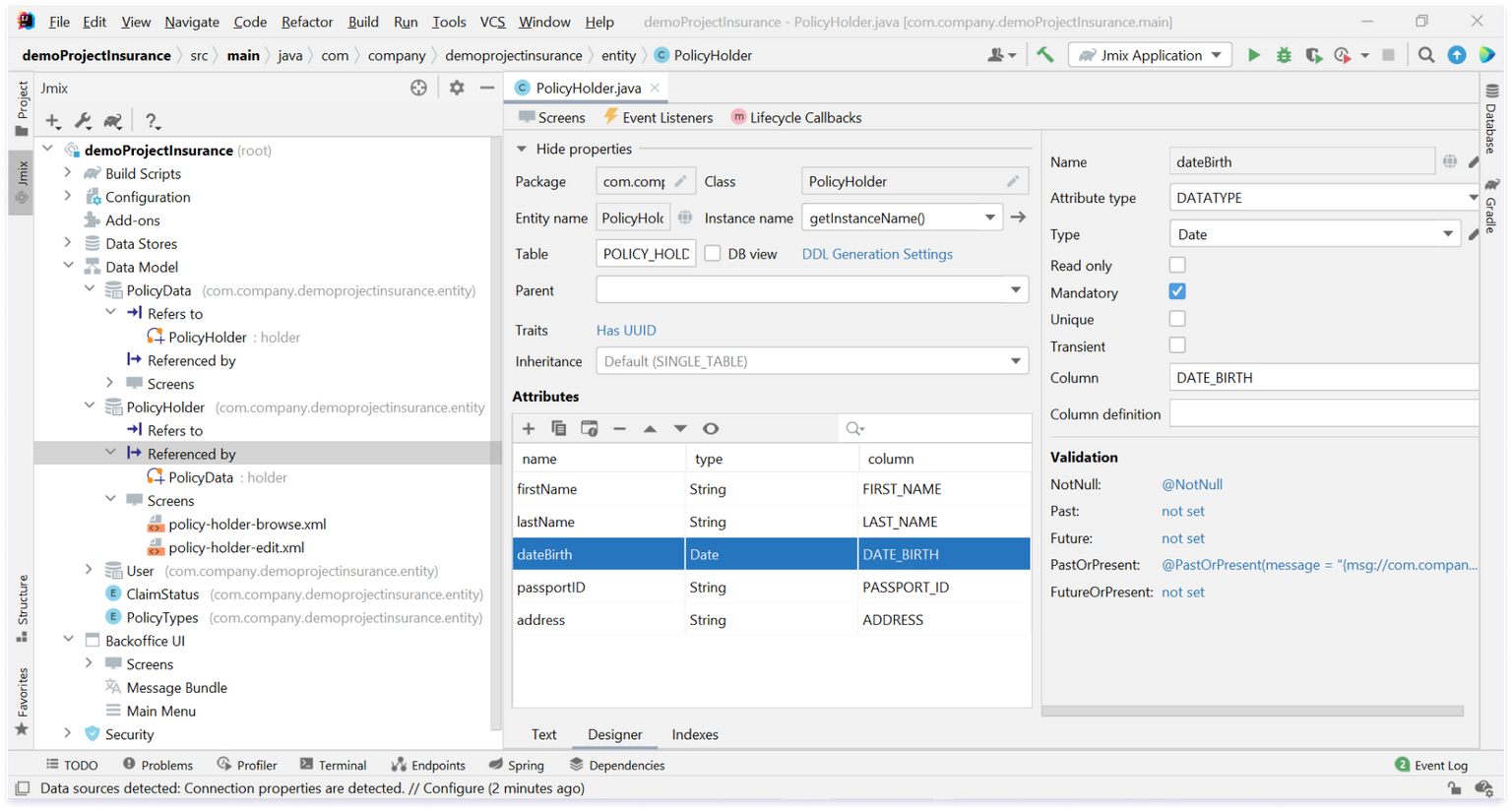

Jmix technologies are modern, reliable and secure, enabling businesses to develop their own flexible applications without incurring cumbersome costs of development.

The standard Jmix UI stores objects that reflect the UI state in users' web browsers in the application server memory. This means that server memory size (or total memory size of all cluster servers) equals the maximum number of connected users. The main consideration when using Jmix UI is predicting the maximum number of connected users in order to calculate memory requirements in advance. Memory requirements depending on the application and data shown in the UI, but typically, it will be 5-10MB per user – this means that one server with 10GB of available memory can serve approximately 1000 simultaneous users. The largest applications developed at Haulmont support over 10,000 simultaneous users.

When using separate frontend applications that connect with the Jmix backend via the REST API, there are no memory limitations because REST is stateless. Therefore, it is common practice to create a frontend for the external users if the number of simultaneous users is likely to be unpredictable.

Some sceptics believe that open-source platforms are less secure than proprietary software. This is not true; the key difference and advantage of open-source code is that it can be analyzed by a much larger number of specialists with full access to the application source code. This speeds up the time taken to eliminate vulnerabilities as nothing is hidden in the so-called ‘black box’.

CUBA Platform, the previous generation of Jmix, has been developed as an open-source project since 2016. The platform team openly publishes the product development plan and maintains the development in the public GitHub repository. The Jmix platform is a mature open-source project based on a modern and robust technology stack. The platform experience does not exclude all security risks and tracking and prevention is essential. On GitHub, we have an active community of 25,000 developers and over 1,000 completed projects, a solid foundation for creating secure applications.